Next Steps For Serialization In The Pharma Supply Chain

Over the last two decades, the global pharmaceutical industry has been working to secure the supply chain, through the development and implementation of serialization standards in over 50 markets. Although outliers remain, in general, pharmaceutical products in the impacted markets will have unique identifiers in an attempt to secure the legitimate supply chain from infiltration of counterfeit, diverted, and adulterated products. Markets have enacted regulations, whether it is applying serial numbers to certain packaging levels or reporting batch data to national agencies, that enforce the use of unique identifiers. In addition to supply chain security, serialization allows for clearer identification of products and improved financial controls, utilizing globally unique numbers, bar codes, and standards that enable patient safety at all nodes of the supply chain.

The industry has made unprecedented progress and addressed several challenges to ensure FDA compliance with pharmaceutical serialization and traceability requirements within each market. While these requirements contain further regulatory milestones on the horizon, manufacturers, distributors, pharmacies, and other parties in the pharmaceutical supply chain must systematically adopt serialization in their normal business operations. Now is the time to shift the focus to:

- Incorporate sustainability in serialization solutions and business processes

- Implement interoperable data exchange networks

- Start considering how to integrate serialization data to achieve value beyond regulatory FDA compliance

Building Sustainability

Considering the progress the industry has made to date, organizations now have the opportunity to incorporate serialization into existing processes. Building solutions and implementing systems to ensure regulatory FDA compliance is one thing, but sustaining FDA compliance while maintaining innovation, speed-to-market, and business continuity is another.

Drug manufacturers and their supply chain partners should begin by understanding how serialization has enabled their regular business operations to focus upon sustaining those business processes. Mapping out every impacted functional area and business process with the additional touchpoints that serialization introduces would be a starting point. Assessing these processes against potential future business events would provide insights into whether the organizations have adequate people, processes, technology, governance, and controls to support these events. This should provide the baseline for defining a sustainable future operating model in a serialized world. Examples of business events and scenarios that organizations should consider include:

- Introduction of serialization and traceability requirements in a new market or regulatory changes in existing markets

- Mergers and acquisitions

- Supply network changes or transfers

- Distribution or logistics network changes or transfers (contract manufacturing, third-party logistics)

- Product launches, divestitures, and discontinuations

- New business relationships, such as co-licensing/marketing/promoting/distribution

- Post-marketing or distribution activities, such as recalls, market withdrawals, returns, complaints, investigations, audits, etc.

When organizations build holistic serialization programs that seamlessly and sustainably fulfill requirements and support ongoing business operations, they are able to build future value.

Exchanging Data Over Interoperable Networks

While serialization requirements ultimately aim to provide patients with products that are kept secure throughout their distribution life cycles, they have begun to foster a culture of strengthening existing relationships. This is being enabled by increased data sharing across the pharmaceutical supply chain, underpinned by a data exchange network to support each transactional event, from manufacturing of the product through dispensing to the patient. As a result, serialization processes capture vital digital data along the various points in the supply chain, resulting in greater insights and improved execution.

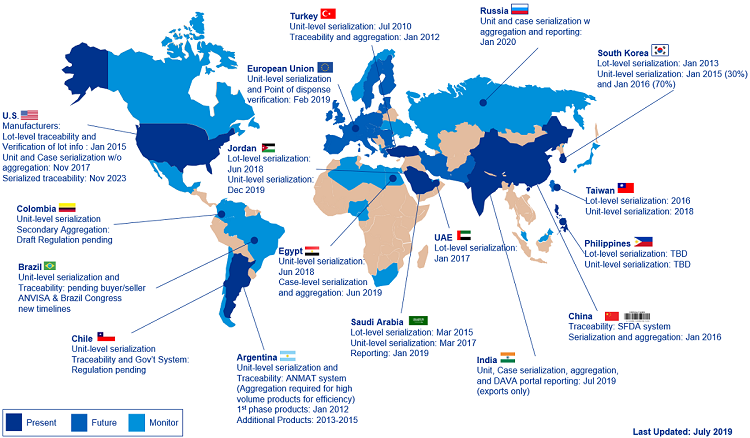

Over the last several years, both major and small/mid markets have implemented their serialization requirements, where every saleable unit of prescription medicine is identified with a unique serial number associated to the batch. Over the next decade, most of these markets have additional requirements that mandate exchange of the serialization data throughout the supply chain. Examples of ongoing regulations include U.S. Drug Supply Chain Security Act (DSCSA) 2023 unit-level traceability requirements and legislation in Saudi Arabia, Russia, China, and Brazil. Refer to the global map for additional information on markets requiring traceability in addition to serialization now or in the future.

Figure 1: Serialization and traceability requirements and deadlines (Click the image for a full-size version.)

With the varying approaches to traceability taken by markets around the world, trends and technologies have arisen that are causing supply chain participants to rethink their strategy on interoperability. For example, companies, industry associations, and consortiums are investing in blockchain technology or similar digital exchange networks to achieve interoperability. While these trends are new and thus still being developed, they are spurring organizations to have those conversations with their trading partners. Incidentally, KPMG is part of an FDA pilot program with a major drug maker, a leading retail pharmacy, and an alliance partner to explore the use of blockchain technologies to meet the unit-level traceability requirements of the DSCSA regulations.

Driving Operational Value From Serialization Data

Once organizations have sustainable business processes in the post-serialized world and continue to work toward the goal of establishing interoperable data exchange networks, they can expect to see real business value from the significant FDA compliance-driven investments that have been made. Ultimately, the question must be asked: How can the unique encoding of a serial number for each saleable unit within a batch, which can be tracked through the entire supply chain, be leveraged for business value?

In addition to improving supply chain visibility and efficiency, there are additional benefits that the organizations could realize in the areas of product recalls and certain financial reconciliation processes such as chargebacks and returns.

Product Recalls

Product recalls are of particular interest because of the risk to patients and the current processes that lend themselves to optimization. Even with the addition of unique identifiers to the product, it is not likely the scope of recalls will narrow. Instead, by leveraging those unique identifiers and interoperable data exchange networks, organizations can identify impacted parties, notify them, and withdraw the impacted product in a shorter amount of time.

Today, a product is recalled by batch. When a recall is initiated, the manufacturer must review its sales orders and notify all customers with whom they transacted regarding the impacted batches. Depending on the severity of the recall, the manufacturer must also notify dispensers downstream. These important communications take time to execute. They can include phone calls and survey packages sent via mail to individual dispensers to inform them and ask whether they have impacted batches on their shelves.

Serialization and traceability enable products to be accounted for, down to the saleable unit level. Instead of passively allowing the information to reach the potentially impacted dispensers, queries can now be made immediately to identify the location of the product. This immediate identification can trigger targeted communications, potentially preventing a recalled product from being further released through the supply chain or, worse, to a patient.

Financial Reconciliation Processes

Unique identification of the pharmaceutical products presents an opportunity to mitigate some of the back-office guesswork that plagues the supply chain as it relates to chargebacks and non-saleable returns. Leveraging individual serial numbers as keys can benefit all trading partners by automating currently manual processes and freeing up resources to focus on more value-added work. At any given time, a significant amount of money is unnecessarily tied up in arbitration between manufacturers and distributors. By associating a sale price with an individual serial number, complex lot-based reimbursement calculations, over- or under-reimbursement, and non-value-added work can be suspended while promoting equitable compensation for all nodes of the supply chain. Let us look at a couple of financial reconciliation processes that could potentially be optimized with serialization and traceability capabilities.

Chargebacks

Revenue reconciliation in the U.S. pharmaceutical supply chain is exceedingly complex due to the extensive contracting among the roughly 600 manufacturers, 50 distributors, and more than 60,000 pharmacies. A manufacturer traditionally sells the product to a wholesale distributor at a list price or at a modest discount based on mutually agreed terms contingent on volume, performance, or other KPIs. The wholesaler in turn then sells the product to a dispenser that has contracted a discounted rate with the manufacturer. The wholesaler submits a “chargeback” to the manufacturer for the difference in price and all parties are made whole. The chargeback process, underpinned by contracting systems interconnected across the supply chain via EDI, is reliant on timely and synced transactional and master data. The challenges with these systems and associated processes are focused in three specific areas. The first is timely updates of pricing changes. Manufacturers, by and large, send pricing updates via email or fax at the end of a business day, when all orders have cleared their order to cash platforms. Wholesalers continue to process orders through the evening and into the next day based on the previous pricing. Pricing changes for individual products are far from frequent, typically quarterly or yearly but, extrapolated over hundreds of manufacturers and thousands of products, these changes happen daily.

Next, for several reasons, hospitals and dispensers can migrate between contracts and access products at different prices. Rostering of entities associated with specific contracts facilitated by group purchasing organizations, private entities, and government organizations change faster than they can be updated across the supply chain.

Finally, master data for new products are typically shared via the exchange of Excel files between trading partners. Due to the volume of new launches in the pharmaceutical industry, this has remained sustainable. Changes to existing products, specifically the units of measure and counts for secondary and tertiary packaging, are not subject to standardized communications methods and often are only discovered by downstream partners reconciling transactions.

Returns

Non-saleable returns are a reality in the pharmaceutical industry. Roughly 2 percent of product introduced into the supply chain will be returned, unused, for destruction. Policies of individual manufacturers and for individual products vary, but the single largest driver for non-saleable returns is expiration dating. Policies are frequently crafted to offer some form of credit or reimbursement at or near the date of expiry. This promotes the promulgation of effective medicines and allows parties to equitably repurchase the product to ensure accessibility for patients.

Reimbursement for products is handled slightly differently by every manufacturer, but the common denominator is that the base price used to calculate the reimbursement is an educated guess. Since a product and batch combination can be sold to the same customer at various price points, pricing a return accurately is impossible due to price changes and handoffs along the chain.

Optimized Reimbursement With Unique Identifiers

Enabling accuracy in reimbursement in both the returns space and via chargebacks will require a few enablers from a manufacturer and distributor perspective. The first enabler has already been accomplished by manufacturers with the unique identification of each saleable unit and aggregation to the secondary packaging. Next, manufacturers must begin capturing which serial numbers are associated to an individual sales order, as well as the line item price for which that product is sold. Finally, manufacturers must be able to capture serial numbers submitted with a chargeback request or upon the products’ return.

On the distributor end, wholesalers must begin to associate individual serial numbers with sales orders to their downstream customers and establish a logical link between that serial number and the sale price. In addition to the lot number, the National Drug Code (NDC), and expected chargeback amount requested, the wholesaler needs to include the serial number or numbers of the product sold.

Two specific things need to happen for this process to work. First, the EDI transactions associated with chargebacks must be updated to include serial numbers. Further, because many manufacturers outsource the facilitation of returns, returns providers must capture and provide the serial number of a returned item in addition to the NDC, count of product, lot number, and other attributes currently transacted today.

Leveraging the serial number and an interoperable data exchange network, the accuracy of returns reimbursement can be exact if these business partners can establish the right financial incentives and gain sharing agreements. Chargeback arbitrations can be minimized as discrepancies can be narrowed to individual forward logistics transactions and their corresponding master and transactional data. Supplemented with enhanced sharing of pricing and master data via GDSN (Global Data Synchronization Network) or other automated means, drastic reductions in the manual effort can be gained.

Conclusion

The global pharmaceutical industry has made tremendous progress in the development and implementation of serialization and traceability requirements. There will surely be more regulatory changes and technology trends to come. However, organizations should take the opportunity now to build sustainability into their business operations, collaborate in interoperable data exchange networks, and consider financial benefits with recalls and financial reconciliation processes.

Credit: Pharmaceutical Online Sept 2019